Oftentimes, when we hear the phrase “trust fund kids” we picture young people who are wealthy, over privileged, spoiled and from rich families who inherit generational wealth and drive expensive cars around while painting the whole town red.

As a parent, you most probably see

creating trust funds for your children as enabling

them to be spoiled and would certainly not want to

set one up for them. Today, we are going to unravel

that misconception, bin it in the trash and bury it.

Then also find out what having a trust fund for your

kids really entails. Let’s start with defining what

trust fund means.

As a parent, you most probably see

creating trust funds for your children as enabling

them to be spoiled and would certainly not want to

set one up for them. Today, we are going to unravel

that misconception, bin it in the trash and bury it.

Then also find out what having a trust fund for your

kids really entails. Let’s start with defining what

trust fund means.

WHAT IS A TRUST FUND?

A Trust fund is a legal entity in trust that holds assets i.e., investments, cash, real estates, private business, arts & antiquities, bonds, stocks, mutual funds; set up by parents or family members to cater for future needs of their children or grandchildren, other relatives – as the case may be.

Trust funds are established so that if the parents are not around to provide for the child, the child has a source of income and assets necessary to survive and are dispersed when the child reaches a certain age that is specified by the grantor.

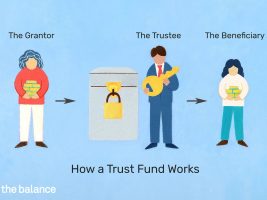

Trusts are made up of three parties: the grantor, who sets up the fund; the beneficiary, who the fund is set up for; and a trustee, who would be in charge of overseeing the fund and its disbursement.

There are majorly two types of trust funds – although there are different types – irrevocable and revocable.

Irrevocable trust are trusts that cannot be changed once they are created, but they offer complete protection and can never be modified or revoked after creation.

Revocable trusts are trusts that allow the grantor i.e., the parent or relative to retain control over the trust, but it will remain subject to seizure in legal circumstances and can be modified or revoked at any time.

WHY YOUR KIDS NEED IT

Setting up trusts for your children can protect their assets not only now, but in the future and provides them with financial security until they can begin making their own. Trust funds can also be beneficial to you when it comes down to paying their university tuition. Saving towards their education, through long-term savings before they get to the tertiary age relives you of the financial burden, rather than wait until they are at university attending age.

Also, in the advent of anything happening to you or your spouse, a trust fund comes into play to take care of the kids in your absence without having them suffer or struggle. Think of it in relation to life insurance, which is also set up for provision to loved ones after a person’s demise.

Not only does having a Trust fund for your kids serve as a layer of protection for your loved ones, it will be on your terms. Assets that are safeguarded in a trust typically do not have to go through probate. This makes the distribution of your assets so much more seamless.

Trust funds are powerful financial instrument that you can use to safeguard your children and other loved ones, in the way you want.

The stereotype – which is not based on facts – that trust funds are specifically for rich kids from rich homes is gradually rescinding. With the growing sensation on wealth creation in the new age, Trust funds aren’t just for the wealthy folks anymore and not all trust funds are for children of well-to-do parents. Middle class people have begun setting up assets for their kids too.

Not sure how to get started on this? Send us a mail and request for financial guidance on how to begin the journey towards realizing the ambitions you hold for your children. Don’t wait until you are wealthy; start today.